Australia is gearing up to launch its very first spot Bitcoin exchange-traded fund (ETF) that directly holds the cryptocurrency. The Monochrome Bitcoin ETF (IBTC) is scheduled to begin trading on the Cboe Australia exchange on Tuesday, June 4.

While Australia already offers various exchange-traded products linked to Bitcoin, Monochrome Asset Management has become the pioneer to receive approval under a new crypto asset licensing category established within the Australian Financial Services (AFS) licensing regulations in 2021. This unique approval allows IBTC to hold Bitcoin directly, setting it apart from other ETFs that indirectly invest in the cryptocurrency or utilize offshore Bitcoin products.

Monochrome ensures the security of IBTC’s holdings by storing them offline in a device disconnected from the internet, along with a crypto custody solution that complies with Australian institutional custody standards.

CEO Jeff Yew expressed confidence in the strong interest that IBTC is likely to attract, particularly given the consistent growth of indirect Bitcoin ETF products in recent times. Monochrome is also prepared to develop and launch an Ether (ETH) ETF, which will follow a similar approach of directly holding the asset.

Yew emphasized that Australia is a crypto-friendly nation, predicting that local spot Bitcoin ETFs could attract net inflows ranging from $3 billion to $4 billion in the initial three years of operation.

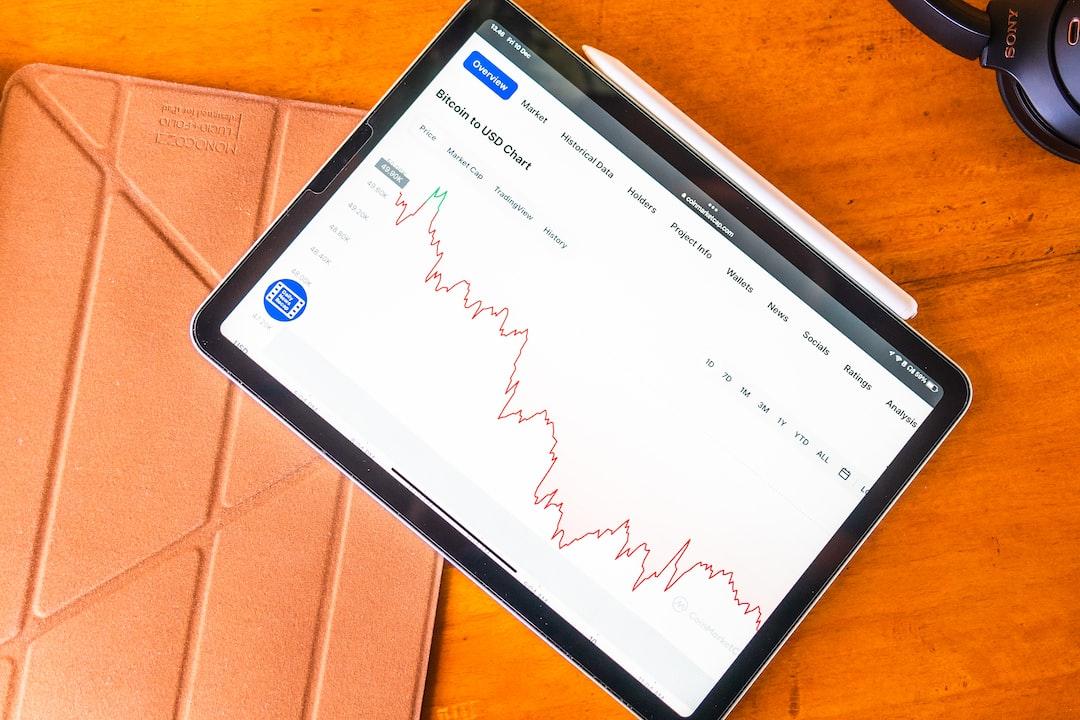

The launch of IBTC in Australia follows closely on the heels of the introduction of four spot Bitcoin ETFs in Hong Kong in late April. While the Hong Kong ETFs have experienced net outflows since their launch, the U.S. Bitcoin ETFs have shown better performance, with cumulative inflows of $13.9 billion.

Looking ahead, Monochrome is exploring additional opportunities within the digital asset sector to meet the growing demand from investors. The launch of IBTC marks a significant milestone in Australia’s cryptocurrency landscape, reflecting the country’s embrace of digital assets as a mainstream investment option.