After a vote by the Aave decentralized autonomous organization (DAO), which governs changes to the lending protocol, the GHO stablecoin has been successfully launched on the Arbitrum network.

In addition to Arbitrum, Aave’s DAO plans a phased rollout of the GHO stablecoin across multiple networks, choosing Arbitrum initially for its cost-efficiency and enhanced transaction capacity within layer-2 networks.

This phased approach prioritizes security and risk management, enabling the DAO to cautiously expand GHO’s footprint across different blockchain ecosystems.

Chainlink’s CCIP protocol facilitates multi-chain functionality for GHO

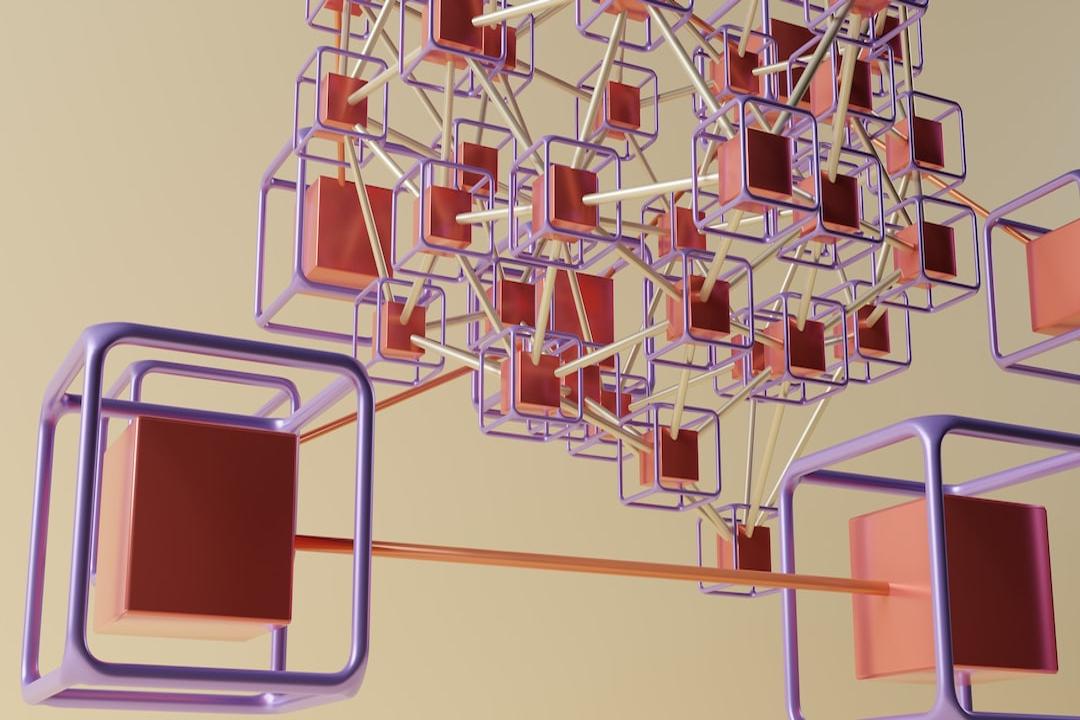

Chainlink’s CCIP protocol serves as the crucial interoperability layer enabling the Aave DAO to migrate the GHO stablecoin from its initial launch on Ethereum to Arbitrum, and potentially to other networks in the future.

![img]

A visualization demonstrating Chainlink’s CCIP interoperability protocol in action. Source: Chainlink

Interoperability of the stablecoin is achieved through two mechanisms: the burn-and-mint model and a lock-and-release function. These mechanisms involve locking or burning GHO tokens on the source chain and releasing them on the new chain.

For instance, when bridging GHO stablecoins from Ethereum to another blockchain, tokens are locked in a smart contract, termed the “Vault Contract,” on Ethereum, and then minted on the target blockchain by a facilitator.

Conversely, when GHO is moved from a different blockchain to Ethereum, the tokens on the alternative chain are burned, and an equivalent amount is released from the Vault Contract on Ethereum.

If neither chain is Ethereum, a facilitator performs the burn-and-mint process to ensure seamless transfer of GHO tokens.

Chainlink and Arbitrum: Strengthening Collaboration

The partnership between Chainlink and Arbitrum, which originated in 2020, has evolved into a collaborative effort aimed at advancing cross-chain decentralized application development.

Chainlink has emerged as a prominent player in blockchain interoperability and oracle networks, driving experimental initiatives to facilitate value transfer across different blockchains, including collaborations with global entities such as the SWIFT interbank messaging system.

In 2024, Chainlink’s CCIP has seen significant adoption, with cumulative revenue from network fees reaching $377,724 in March, driven largely by activity on Arbitrum.

Read More:

Exploring the Potential of Tokenizing Music Royalties as NFTs